Why A/R Matters: The Data Behind Time Value of Money

CollBox Team

“Time is money” is a quote we’ve all heard at some point. It is said to have originated in 1748 within an essay written by Ben Franklin. The purpose is to say that we can choose to work in our free time to make money; thus time spent is money not earned.

The world of money has become significantly more complicated since 1748. Yet, the way systems and our philosophies have evolved has made this quote even more true. Take, for instance, investing. It quite literally generates money over time. Now more than ever, we know just how much of an impact misused money has on our long-term finances.

The quote also rings true when it comes to A/R, Accounts Receivable. In particular, opportunity cost – how much the inability to use uncollected revenue sets businesses back. This is explained in part by the time value of money. How this principle applies to A/R and why it’s important for both you and your clients is a critical part of making informed decisions both as a business owner and one who works with other businesses.

What is the time value of money?

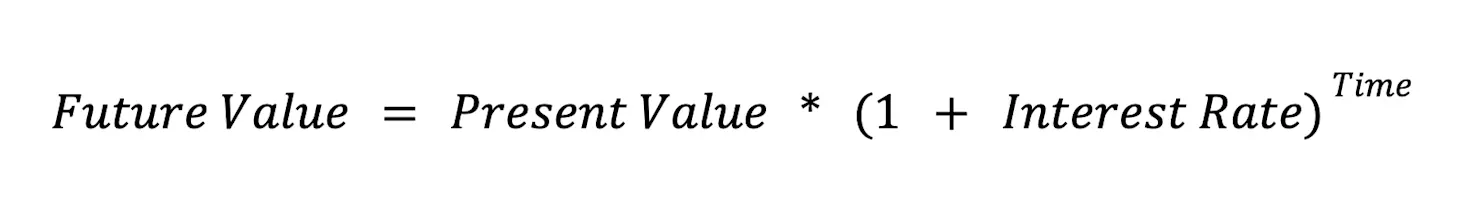

The time value of money is the way to calculate how much an amount of money will be worth at some point in the future. It’s measured with a very simple equation:

In this equation, present value is the amount of money you start with and both interest rate and time are set by you. So to measure the lost value on overdue A/R, you could set the interest rate as the percent return on a savings account, investment averages, or the rate of inflation (the U.S. Federal Reserve targets 2%).

Time needs to reflect how the interest rate is measured. For example, if you are using an annual interest rate, time should be measured in years.

Why does the time value of money matter?

If your clients aren’t generating money with the money they have, they’re effectively losing money because of inflation. This is especially true when it comes to money tied up in outstanding A/R balances.

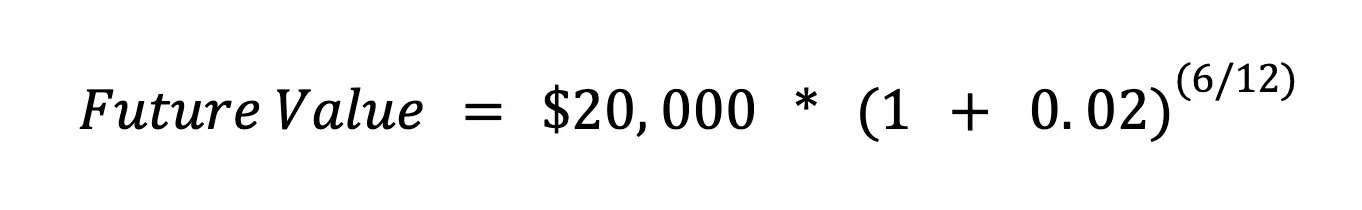

For example, if a business currently has $20,000 in outstanding receivables that have gone uncollected for 6 months, the time value equation of that money using the rate of inflation looks like this:

A quick calculation shows the future value is approximately $20,199.00. This means that if they collect all the payments now, they have lost almost $200 just off of inflation alone. This is true if the money is just kept passively. It does not take into account what they could have used that money for if they had had access to it in the present. Maybe that money goes into marketing which could double the money using Google Ads or generate a potential 36x return using email marketing.

The time value of money and A/R services

Businesses lose money every day by not being able to use their uncollected revenue as a tool to generate money. This means that bad Accounts Receivable processes are costing businesses money. As with anything that causes people to lose out on money, there is a willingness to pay to prevent that loss from happening.

The maximum amount someone should be willing to pay for an A/R service is the amount they’re losing in missed opportunities. This means there is a revenue opportunity for your firm if you can help your clients solve this problem.

Let’s break down how you can use the time value of money to help you define the value of your A/R services for clients.

The time value of money and making a sales pitch

While the time value of money is a concept you could explain, it’s even more effective if you can show them the actual results. Using a future value calculator is a fantastic way to do this.

Start by working with a client or prospect to set your interest rate. Ask them what they would expect as a return for a dollar spent. Tying this into marketing spend is the easiest way to illustrate the return – it is straightforward and many of the metrics are based around return on investment.

However, using a return on marketing won’t work with some industries where marketing isn’t a prominent expense. In this case, you could use the interest rate of outstanding credit card debt, paying down the principal of a loan, or the expected return on time or money that would be saved with a big purchase like a new piece of equipment.

The time value of money and pricing your services

People should be willing to pay an amount for an A/R service that reflects the time value of their money. When pricing out an accounts receivable service, it is important to look at the potential returns for your clients using this same measure.

A good place to begin is to look at the cases that would have the highest value return on an investment in your services. Then, look at those who would achieve the lowest value return, and then the return for someone around the median. This is easy to do so long as you have access to the accounts receivable balance for your clients.

Once you’ve crunched the numbers and have the lowest, highest, and median values, you can start thinking about what’s a reasonable price range for your services. If you select the lowest value, then every client would theoretically benefit from and thus buy your services. If you select the median, around 50% of your clients would benefit from and potentially buy your services. Take into consideration how much additional work providing an A/R service will be for your firm and how many clients you want to provide it to in order to optimize your own time value of money and choose a price accordingly.

The time value of money and your firm

The time value of money and opportunity cost don’t just apply to your clients. This same kind of analysis should be done for your firm. Just as you want to protect the time and money of your clients, you need to look after your own time and money. After all, time is money.

Whether the idea of the time value of money is a widely understood concept or not, one thing most firm owners understand is that a straightforward way to optimize your time is to automate parts of your work. Considering how to offer and optimize A/R services is no exception. CollBox is a perfect partner in offering A/R services that work for both your firm and your clients.

CollBox is an A/R platform that takes over all the worst parts of chasing down unpaid invoices. It identifies accounts that are becoming problematic, provides a dashboard for monitoring all your clients’ A/R balances, and even follows up on past-due invoices on your client’s behalf.

CollBox starts with automated payment reminders and friendly follow-ups for slow paying customers and invoices and even makes friendly, timely, phone calls so your clients (and your firm!) don’t have to. Accountants can also participate in our partner program for a hands off approach to providing their clients the relief they need while increasing monthly revenue per client at the same time.

Get started today and learn more about our options for streamlining the A/R services you provide and clients really need.